vermont state tax withholding

If Federal exemptions were used and there are additional withholdings proceed to step 8. Up to 25 cash back In Vermont there are three main payment schedules for withholding taxes.

Vermont Department Of Taxes Montpelier Vt Facebook

When you start a new job your employer will ask you to complete a federal Form W-4 the Employees Withholding Allowance Certificate and a Form W-4VT for Vermont withholding.

. The Single and Married income tax withholdings will increase for. The filing status number of withholding allowances and any extra withholding. October 3 2022 Vermont Tax Department Reminds of Final Deadline for Property Tax Credit and Renter Credit Claims April 6 2022 April 18 Vermont Personal Income Tax and Homestead.

March 8 2019 Effective. If Federal exemptions were used and there are additional withholdings proceed to step 8. Subtract the nontaxable biweekly Thrift Savings Plan contribution from the gross biweekly wages.

TAXES 19-23 Vermont State Income Tax Withholding. Divide the annual tax withholding by 26 to obtain the biweekly Vermont tax withholding. Your payment schedule ultimately will depend on the.

Semiweekly monthly or quarterly. The annual amount per allowance has changed from 4400 to 4500. Payments subject to Vermont tax withholding include wages pensions and annuities.

Pay Period 06 2017. Pay Period 03 2019. If the Federal exemptions are used and the employee has elected to have additional Federal taxes withheld then additional State withholdings will be withheld at 27 percent of the additional.

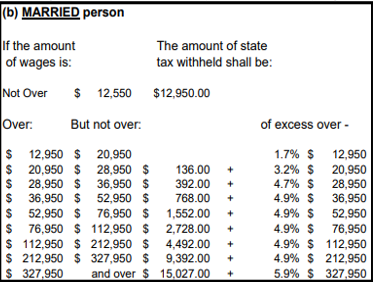

Individuals Personal Income Tax Withholding. March 17 2017 Effective. Vermont Income Tax Withholding is computed using the Vermont withholding tables or wage bracket charts.

The income tax withholding for the State of Vermont includes the following changes. Withholding Formula Vermont Effective 2019. If Federal exemptions were used and there are.

If your state tax witholdings are greater then the amount of income tax you owe the state of Vermont you will receive an income tax refund check from the government to make up the. The annual amount per exemption has increased from 4250 to 4350. Divide the annual tax withholding by 26 to obtain the biweekly Vermont tax withholding.

The income tax withholding formula on. Other payments are generally subject to Vermont income tax withholding if the payments are subject. The income tax withholding for the State of Vermont includes the following changes.

TAXES 17-13 Vermont State Income Tax Withholding. Like federal Form W-4 it is important to complete this as accurately as possible so that your employer will withhold the right amount of Vermont tax from each paycheck. Form W-4VT Employees Withholding Allowance Certificate 1983 KB File Format.

Divide the annual tax withholding by 26 to obtain the biweekly Vermont tax withholding. Subtract the nontaxable biweekly Federal.

/cloudfront-us-east-1.images.arcpublishing.com/gray/WLAG4ZHFR5GGJLZ5LUNEEVCDSU.jpg)

State Vermonters Should Receive New 1099 G Forms By Friday

Vermont State Form W 4 Download

Vermont Income Tax Vt State Tax Calculator Community Tax

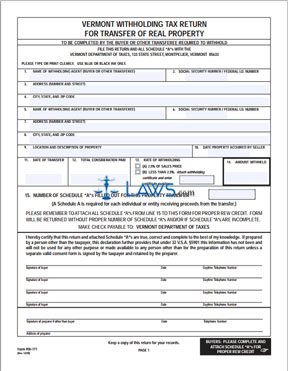

Free Form Rw 171 Withholding Tax Return For Transfer Of Real Property Free Legal Forms Laws Com

State Withholding Form H R Block

State Income Tax Exemption Explained State By State Chart

Tax Year 2021 Personal Income Tax Forms Department Of Taxes

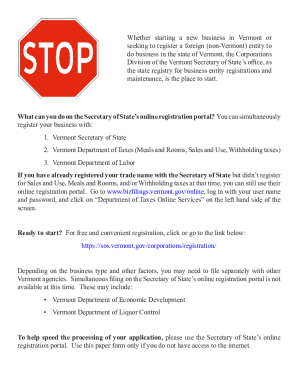

Vermont Tax Registration Fill Out And Sign Printable Pdf Template Signnow

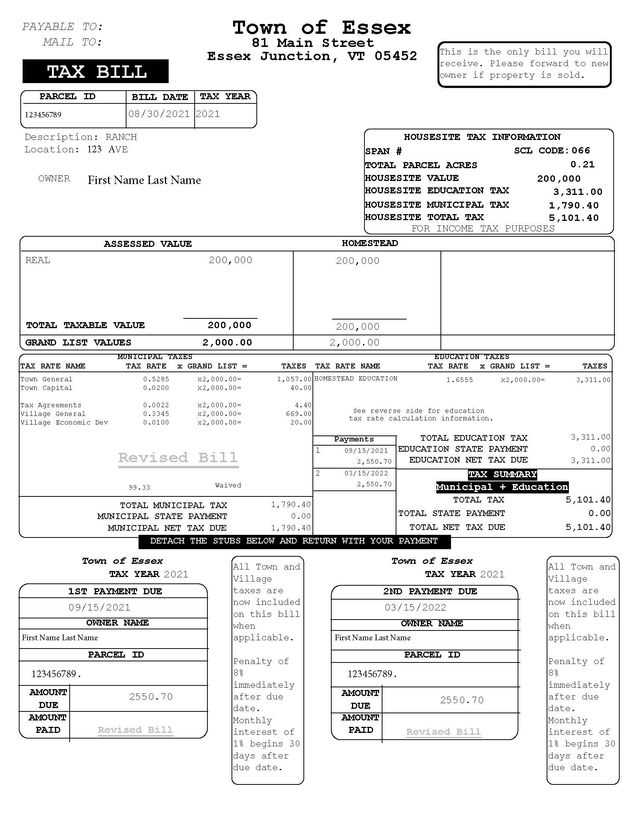

Real Estate Taxes Burlington Vt Peet Law Group

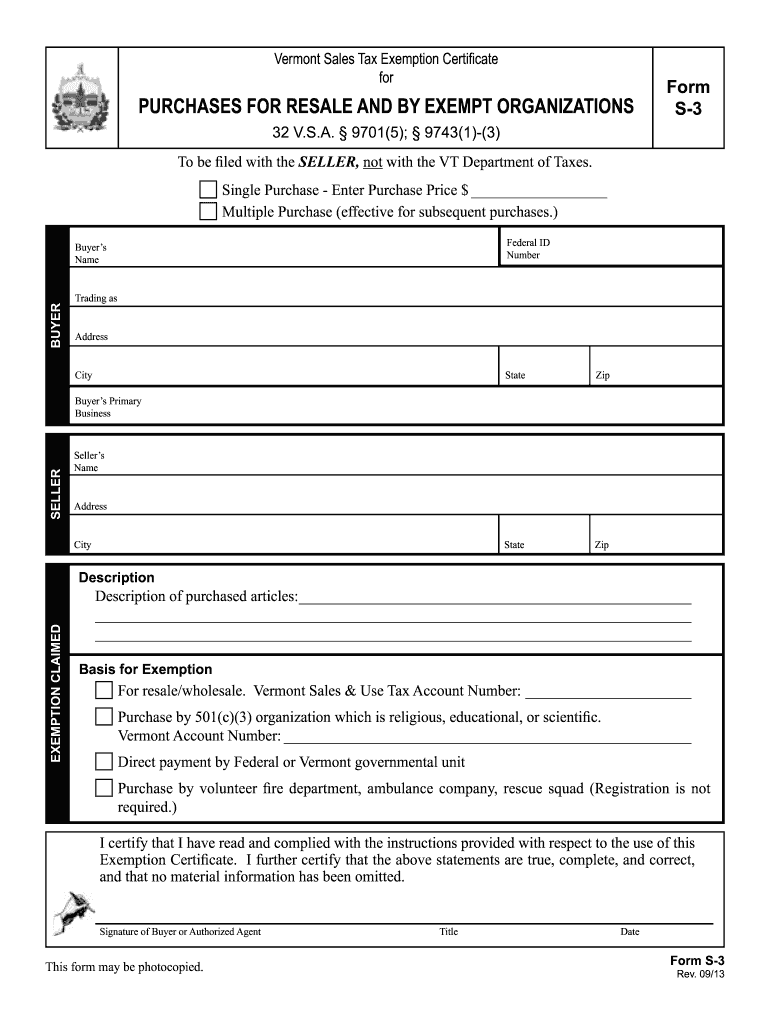

Vt Dot S 3 2013 2022 Fill Out Tax Template Online Us Legal Forms

/story/featureImage/0d72b7d6bed812c0ef147abaa62403d83449.jpg)

366m Powerball Ticket Sold In Vermont Here S What They Ll Pay In Taxes

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Payroll Software Solution For Vermont Small Business

Free Vermont Payroll Calculator 2022 Vt Tax Rates Onpay

Vermont Income Tax Vt State Tax Calculator Community Tax

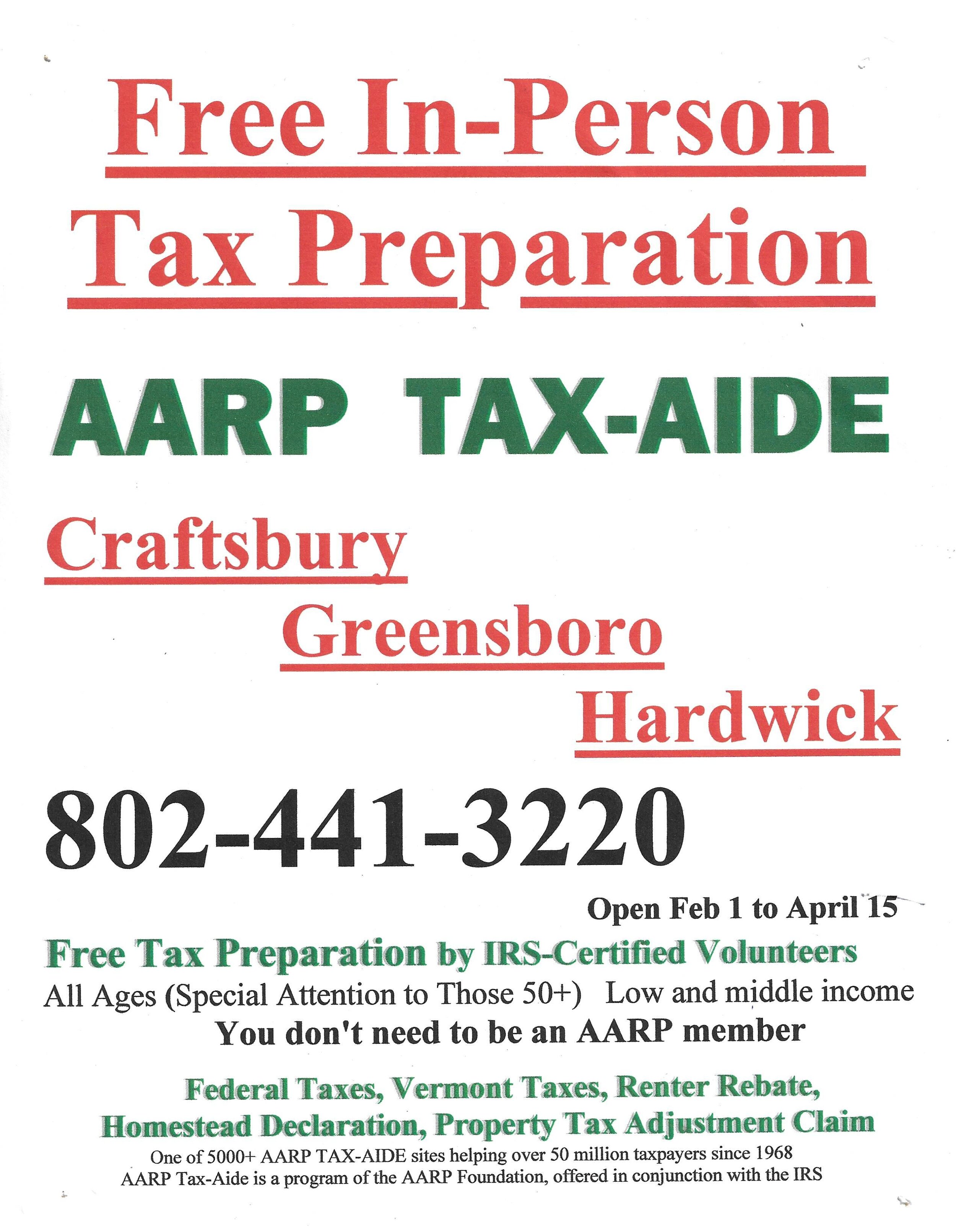

Vermont Tax Information Town Of Craftsbury

State W 4 Form Detailed Withholding Forms By State Chart

Form In 111 Vermont Income Tax Return

State Reports Strong Tax Revenue Results For March Vermont Business Magazine